B.Rich Realty and Mortgage

-

My Recent Posts

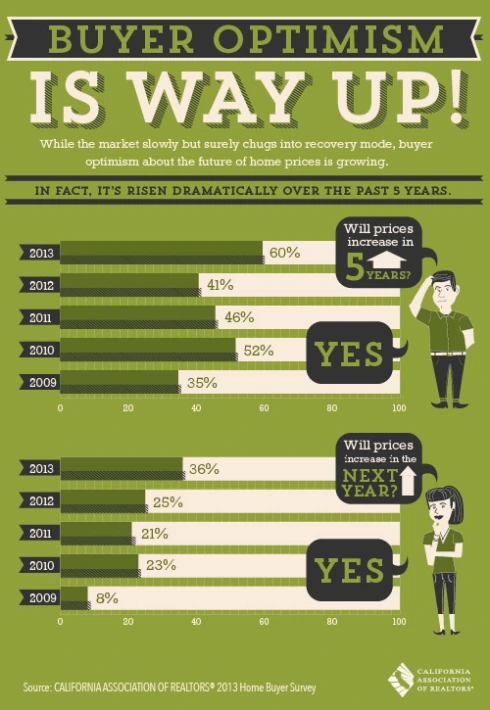

- Buyer’s Optimism regarding real estate values in California- WAY UP! October 22, 2013

- B. Rich Realty September 2013 Newsletter October 11, 2013

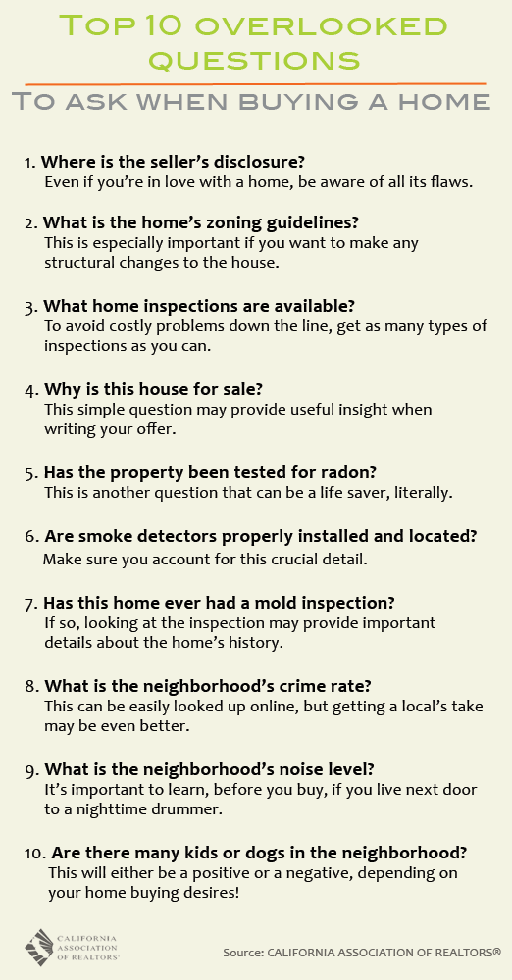

- Buyers be forarmed with these Top 10 Overlooked Questions. September 24, 2013

- HOW TO BUILD YOUR CREDIT September 19, 2013

- WHY WE NEED TO BUILD CREDIT? September 11, 2013

-

Join 201 other subscribers

Buyer’s Optimism regarding real estate values in California- WAY UP!

Posted in real estate

Tagged B. Rich Realty, buy now, California Real Estate, optimism, way up

Leave a comment

B. Rich Realty September 2013 Newsletter

B. Rich Realty September 2013 Newsletter

Get the latest real estate update from B.Rich Realty. Check out year to year comparison of your cities in southern California. If your City is not specifically mentioned, give us a call (714-680-0210) or send us a message and we will provide that information to you.

HOW TO BUILD YOUR CREDIT

Credit cards Français : Cartes de crédit Italiano: Carte di credito Русский: Банковские карты Tiếng Việt: Thẻ tín dụng 中文: 信用卡 (Photo credit: Wikipedia)

My last blog was about “Why you need to build your credit”. To further emphasize the points mentioned in my last blog, I just want to share with you that today I booked airplane tickets for two, made reservations for a two-night stay in a 5 star hotel and a car rental for two days…all using points from my credit card. So, if you are young or a recent immigrant, it is time to make those credit card charges work for you! But first, let me tell you how to build your credit.

There are several ways to build credit. Whichever method you use, it is essential that your lender reports your activity to the credit bureaus. If they don’t, you won’t build credit. Ask your lender if they report to credit bureaus before borrowing, and then verify by checking your credit reports after at least 30 days.

Get a secured credit card from your bank or credit union. These cards are easier to qualify for because you deposit money with the bank before using the card, and your limit will be the same as your deposit. As a result, any spending you do with the card is “secured” by the money you’re letting them hold onto – if you don’t pay off the card, they can take your deposit. For example, you might deposit $500, and you’d get a secured credit card with a limit of $500. Note that a secured credit card is not the same thing as a prepaid debit card.

Use a co-signer (who has good credit) to help you qualify for a loan. Lenders will consider the co-signer’s existing credit. The co-signer essentially ‘vouches’ for you while you build credit. Note that this is a big responsibility – you can cause major headaches for the co-signer if you don’t pay as agreed.

Become an authorized user on somebody else’s credit card (usually a parent or a spouse). This practice adds the account to your credit files, and helps you build credit.

Use retailer programs for modestly large purchases like furniture. For example, you might buy a sofa on the “$40/Month Payment Plan”. Gas station cards can help as well. These programs can be easier to qualify for than traditional credit cards, and they certainly help you build credit.

Apply for a personal loan at your bank or credit union. Using an unsecured loan helps you move beyond credit cards and loans from retailers. Instead of paying as you charge, you’ll make a regular monthly payment (which the credit scoring programs like to see).

Use different types of loans. As you build credit, use several different types of loans to create a rich mix of loans in your credit files. Don’t borrow for the sake of borrowing, but add in a student loan or auto loan where appropriate (don’t just use credit cards to pay for school or your next car). This shows that you know how to use different types of loans for different situations.

YOUR WORK DOES NOT STOP HERE; you need to make sure your credit continues to grow.

Monitor your credit reports regularly. The US Government requires the credit bureaus to provide a free credit report to you annually, and you should take advantage of this free service. Go to annualcreditreport.com to order your free credit report.

If you use any kind of credit card, be sure not to spend anywhere near the limit on the card. Try to stay below 30% of your limit (for example, if your limit is $1000, don’t spend more than $300 without paying off the balance).

If you’re having an especially hard time building credit, just start doing things that may eventually be used on “alternative” credit reports: get utility accounts (gas and electric) in your name, and be sure to pay your mortgage or rent on time. It might even help to open a checking account at a small bank or credit union. Using those accounts responsibly may improve your chances. There’s no guarantee that a lender will take this information into consideration, but it’s better than nothing.

WHY WE NEED TO BUILD CREDIT?

In the early 1980s (ooops, I am disclosing my age) when I first came to America, I hardly heard of credit cards. In the Philippines where I grew up, the only “credit” being extended are loans from banks to fund real estate purchases or businesses. But, we had our own credit card version – we fondly like to call “gives”. “Gives” is basically installment payments. An agent of a retail store would come to a person’s work place each payday and collect the money owed for a purchase of jewelry or a dress. Usually the item purchased is paid in 4 to 10 “gives” (or 4 to 10 paydays). If you are an Adult Filipino reading this, you know what I mean.

After a few months in America, I had my first introduction to “Credit’. I decided to buy a car. I was surprised to find out that I could actually buy a car with only $800 down payment. The balance was to be paid by a loan. However, I was denied the loan because I had no credit history. The car dealership suggested that I get a co-signor. What is a co-signor? Well, someone that has a good credit and who will take over my loan payments if I become delinquent. My cousin’s husband boldly and kindly co-signed for me.

I started building my credit with the car payments, then I got a 76 gas card, a Broadway (now Macys) credit card, and finally a Visa credit card from my bank. Now, I am proud to say I have a credit score above 800 and made many “Big Item” purchases with my credit.

There are many reasons why we need credit.

Credit provides convenience. Just today, I was at Vons buying flowers for a friend. The only cashier that was open had a long line. The florist cashier was not open, but agreed to ring me up if I pay only with credit card. Yipee…I was in and out in 5 minutes and did not have to fall in line.

Credit allows you to buy big ticket items, you normally cannot afford. With credit I was able to buy houses, televisions, cars and many other items.

Credit provides access to the lowest interest rate (If your credit is good). I always had access to the lowest mortgage interest rate because of my good credit. With low interest rate, my monthly mortgage payments are low and my purchasing power is higher.

Credit allows you to earn miles and points for your credit charges. I have flown to Europe on my credit card points alone.

Purchases on Credit have insurance protection. Once I broke the crystal vase I bought with my credit card. I reported this to my credit card company and they reversed the charges.

Payment on Credit protects you from unreliable sellers or defective merchandise; If you have defective merchandise, the credit card will reverse the payment and not pay that seller.

So, if you don’t have credit, yet! Build one now! You don’t know how? No worries, my next blog will be about HOW TO BUILD YOUR CREDIT.

B.Rich Realty and Mortgage August 2013 Newsletter

B.Rich Realty and Mortgage August 2013 Newsletter

Click the link above to get the current real estate market update in Orange County and Los Angeles County through our Newsletter. We have received several feedback that our Newsletter is very informative and they love it! Hope you will, too.

FIRST TIME HOME BUYER PROGRAMS – THE REAL DEAL!

The reason I say the “Real Deal” is because back in the “glory days” of mortgage lending, a lot of loan brokers advertised their Option One Adjustable Rate loan programs as First Time Home Buyer loans at very low interest rates! Well, we know what that really meant: a) you (the borrower) pay a minimum monthly payment that did not even cover the actual interest due on the loan; b) no payment is applied to reduce your principal balance; c) the interest that you did not pay is added to your current principal balance (negative amortization); your interest rate went up making your monthly payment unaffordable; and lastly (lucky for you) the property values went down dramatically. Hence the housing meltdown of our Decade!

The reason I say the “Real Deal” is because back in the “glory days” of mortgage lending, a lot of loan brokers advertised their Option One Adjustable Rate loan programs as First Time Home Buyer loans at very low interest rates! Well, we know what that really meant: a) you (the borrower) pay a minimum monthly payment that did not even cover the actual interest due on the loan; b) no payment is applied to reduce your principal balance; c) the interest that you did not pay is added to your current principal balance (negative amortization); your interest rate went up making your monthly payment unaffordable; and lastly (lucky for you) the property values went down dramatically. Hence the housing meltdown of our Decade!

Now, let me introduce you to the “Real” First Time Home Buyer Program by the California Housing Finance Agency (Calhfa). Calhfa has adapted to the changes in the real estate market by introducing programs with tools for sustainable homeownership. It is designed to help well-prepared low and moderate income families become homeowners in California. It provides for down payment assistance from 3 to 3.5% of the loan amount.

B. Rich Realty is proud to state that we have helped several individuals and families purchase their first home with the Calhfa down payment assistance program. We could do it for you, too!

Here are some of the featured Calhfa loan programs:

California Homebuyer’s Down Payment Assistance Program (CHDAP)

- 3% down payment or closing cost assistance

- Deferred payment

- Up to 103% Loan to Value (LTV)

Calplus Zip Program:

- FHA insured first mortgage

- Up to 103% Loan to Value (LTV).

- 3.5% of loan amount in down payment assistance at 0% interest with deferred payment.

Extra Credit Teacher Home Purchase Program (ECTP):

- Rewards teachers and staff who serve in California’s high priority schools

- Downpayment assistance from $7,500 to $15,000.

- Deferred payment

- Interest forgiveness in three years

- Up to 103% Loan to Value (LTV).

You have to meet income qualifications and attend a home buyer education seminar.

The best part of all is that some if not all of these programs may be combined together (Calplus with CHDAP) and with other City and County First time homebuyer/down payment assistance programs.

MOST real estate agents or loan brokers are not aware or familiar with these programs. B.Rich Realty is experienced in this field, so give us a call with any questions you may have regarding the “REAL DEAL” First time home buyer programs. Visit our website (www.brichrealty.com) for testimonials. While there, scroll to the Newsletter section for articles regarding our clients who bought houses through the Calhfa loan programs.

Posted in real estate

Tagged 000 downpayment assistance; low income; California Home Buyer; interest forgiveness, Calhfa down payment assistance program, California Housing Finance Agency, CHDAP, closing cost assistance program, Extra Credit Teachers Home Purchase Program (ECTP); 103% LTV; deferred payment; 0% interest; $15, First time home buyer programs

Leave a comment

Homebuilder confidence at an 8 year high

Homebuilder confidence at an 8 year high

Homebuilders are showing their confidence in the housing recovery by investing in the most housing starts and permits since May 2008!

Posted in Uncategorized

Leave a comment

Wow! What bad credit score you have!

I have been reviewing credit reports for the past 15 years and I have never seen them this bad. They are inundated with very low credit scores from one borrower to another. These credit reports are more colorful than a rainbow. They are a kaleidoscope of collection items, bankruptcies, judgments, 30- 90 day delinquencies; and they are usually several pages long, too.

On very rare occasions, I see credit scores of 720 and above; when I do, I can’t help but blink twice, to make sure I was not transposing the numbers. Yes! It could possibly be 270!

Recently, however; I had a borrower with a credit score of 740+. I instantly called the borrower with cheerful congratulations because she had been doing the right thing all along! She was a scarce commodity nowadays and I just wanted to hug her! Why was I so ecstatic?

The “she” is a 28 year- old woman; a college graduate with stable employment who lives with her parents…..but unlike most young adults who work and live with their parents, (which means they don’t pay the basic necessities of life, ie. rent, food and utilities), this 28 year-old woman had some savings and has not overextended herself with the use of credit cards. Now, she is in a very good position to buy a house!

Unfortunately, many young adults living with their parents choose to use their “unrestricted” funds to buy Jamba juice, Boba, go to the movies, buy video games, buy new clothes, go on vacation with friends; and when they ran out of money, they just charge, charge away. They also seem to have forgotten their student loans that their parents probably co-signed for them. In terms of home ownership, the futures for these young adults look very dim.

But wait! Don’t be too dismayed. There are some really great real estate agents out there that will work with people who have bad credit.

B.Rich Realty has helped clients improve their credit scores on their way to home ownership. We like challenges and we want you! Yes, you with the awful credit score! It may take one to two years to get you ready, but we will be there along the way to provide you with education and guidance. Call us at 714-680-0210.